Content

The general journal and general ledger are used by those firms that use double-entry accounting as the best record of their financial transactions. The two major differences between the general journal and general ledger in a business firm are that the general journal is the first place a financial transaction is recorded by a business. Once journal entries are made in thegeneral journalor subsidiary journals, they must be posted and transferred to theT-accountsorledger accounts. Since so many transactions are posted at once, it can be difficult post them all.

Can journaling improve your writing skills?

By journaling regularly, young writers can develop their writing skills and demystify the process through practice. 2. Journaling allows you to explore new ideas. Another benefit of journal writing is having a place to formulate and record ideas for other pieces of writing.

The general ledger sometimes displays additional columns for particulars such as transaction description, date, and serial number. Journal is also known as book of primary entry, which records transactions in chronological order.

How to Account for Cash Receipts

While, in the ledger, the transactions are recorded based on accounts. In general, a business accounting system is designed to keep track of where money comes from and where it goes. Usually, businesses will keep both a journal and a ledger for accounting purposes. The purpose of the ledger is to track broad trends and overall shifts in funds while the importance of the general journal in accounting is to keep track of each individual event. In many modern businesses, both the journal and ledger are actually digital files, not physical books. In the general journal you must enter the account to be debited and the account to be credited along with their amounts and a brief description.

- Check out the post “Maintaining a General Ledger” from Wolters Kluwer for a more extensive list of general ledger accounts that might apply to medium to large businesses.

- Since management uses these ledger accounts, journal entries are posted to the ledger accounts regularly.

- At the end of the financial year, the ledger account is balanced.

- In a journal, the transactions are recorded with a summary while in a ledger the explanation or summary is not needed.

- Journal is a book of accounting where daily records of business transactions are first recorded in a chronological order i.e. in the order of dates.

- Since most accounts will be affected by multiple journal entries and transactions, there are usually several numbers in both the debit and credit columns.

If each account balances, so will your financial statements when you develop them at the end of whatever time period you have established. From these documents, you can develop your financial statements by conforming to the accounting equation. Both the accounting journal and ledger play essential roles in the accounting process. Bookkeepers primarily record transactions https://www.bookstime.com/ in a journal, also known as the original book of entry. The transactions are recorded into a ledger by date from a journal. Every transaction is first recorded into a journal, then the transactions are analyzed and checked and then are recorded into a ledger. The balances and activity in the general ledger accounts are used to prepare a company’s financial statements.

The ledger. What is it?

Because the information in the general journal is organized by date and not by account, the information it provides is not very useful. To be more useful, information must be organized by account. The general journal is a chronological, or date order, record of the transactions of a business.

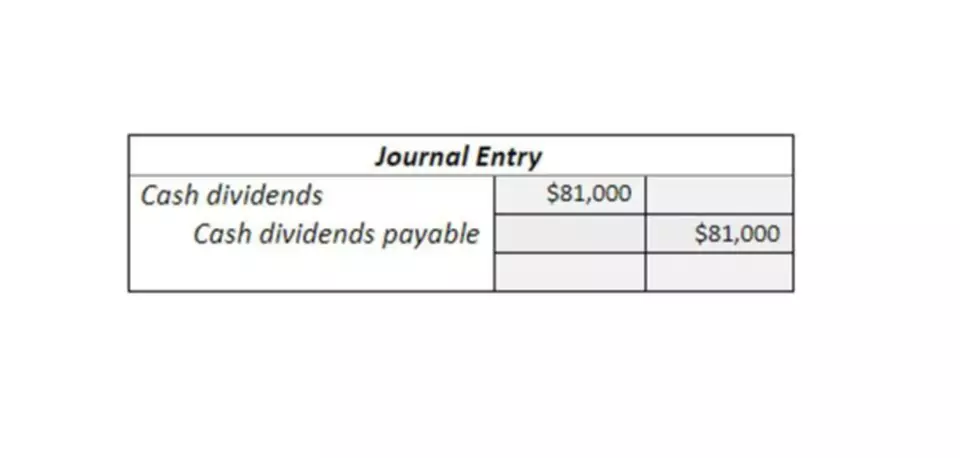

The golden rule states that assets are debited, so you add $5,000 to the debit column of the journal. An equal credit must be recorded to the cash account, so you add $5,000 to the credit journal vs ledger side of the journal. Finally, you note down the description of the transaction as a purchase of furniture worth $5,000. Day-to-day, record your business transactions as they occur.